Some Of Modern Nissan Of Lake Norman

Some Of Modern Nissan Of Lake Norman

Blog Article

Some Known Questions About Modern Nissan Of Lake Norman.

Table of ContentsThe Single Strategy To Use For Modern Nissan Of Lake NormanExamine This Report on Modern Nissan Of Lake NormanWhat Does Modern Nissan Of Lake Norman Do?The Definitive Guide to Modern Nissan Of Lake NormanGetting The Modern Nissan Of Lake Norman To Work

Keep in mind, you'll also pay for the auto registration, taxes and charges, so expect to pay more. When calculating your budget plan, consist of various other auto proprietor expenses like fuel, upkeep, auto insurance policy and repair work.

Moving over your old car loan into your brand-new one suggests remaining to spend for (and pay interest on) an automobile you're no longer using. You might be able to obtain even more cash for your old automobile by marketing it independently over trading it in. After that, use the money towards your down payment.

When you go to the dealership, examination drive the vehicle before you claim yes to acquiring it. nissan sentra dealer near me. You'll see exactly how comfortable it is and whether you like driving it. If you're not searching for a new automobile, get the next-best thing and purchase an accredited previously owned car. They undergo a rigorous certification procedure and feature the added defense of producer extended guarantees.

Get This Report on Modern Nissan Of Lake Norman

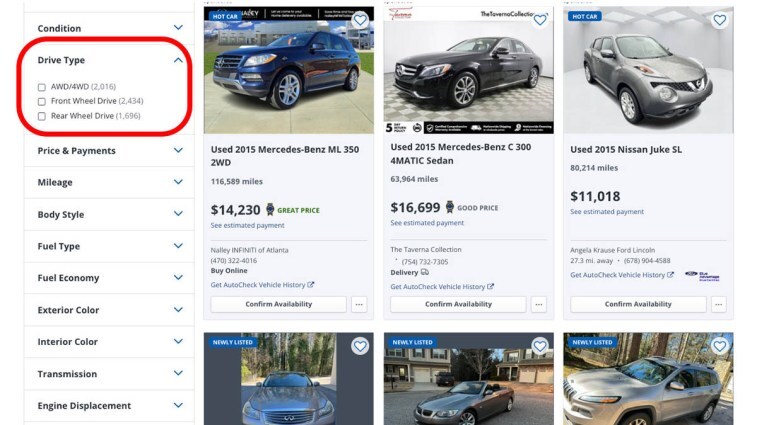

But they likewise come with higher rate tags than routine secondhand vehicles. After you choose the best sort of car for you, look around for the very best rate. Contrast rates on web sites like Autolist, AutoTrader, CarMax and Carvana along with various dealer internet sites. Several of the very best settlement wins originated from having various other car listings to validate why you want a reduced cost.

Getting a longer-term finance will cause you to invest a lot more in passion, making the car much more expensive to finance in the lengthy run - nissan z dealer near me. Long settlement durations can additionally make it tougher to pursue various other financial goals or buy a various vehicle if your situations alter specifically if you still owe a great deal of cash on your loan

Doing your research study, looking around and obtaining preapproved can help you obtain the most effective offer on a new car. If you state the wrong thing to the dealer while negotiating or reveal up at the incorrect time, you can wave bye-bye to all of your difficult preparation work. Also if a supplier asks ahead of time, do not discuss your trade-in or your wish to get a vehicle financing.

The Ultimate Guide To Modern Nissan Of Lake Norman

After you have actually bargained the final vehicle rate, ask the dealer concerning any offers or programs you get approved for or point out any you found online to bring the rate down also much more. Talking of saying the right points, do not inform the dealership what regular monthly repayment you're looking for. If you want the most effective bargain, start settlements by asking the supplier what the out-the-door price is.

Bear in mind those taxes and costs we stated you'll have to pay when buying a car? Suppliers can prolong finance settlement terms to hit your target regular monthly settlement while not reducing the out-the-door rate, and you'll finish up paying more rate of interest in the lengthy run.

Both you and the dealer are entitled to a reasonable offer however you'll likely wind up paying a bit greater than you want and the dealership will likely get a little much less than they desire. Always begin negotiations by asking what the out-the-door rate is and go from there. If the dealer isn't going low enough, you might be able to discuss some specific things to get closer to your preferred rate.

It's a what-you-see-is-what-you-pay sort of cost. Even if you've negotiated an offer doesn't imply you're home-free yet. You'll likely be used add-on alternatives, like expensive technology bundles, indoor upgrades, expanded warranties, space insurance and other protection strategies. Ask yourself if the add-on is something you genuinely require prior to concurring, as a lot of these offers can be added at a later date if you select.

Modern Nissan Of Lake Norman Fundamentals Explained

If you choose to purchase an add-on, work out that price, too. Lenders might call for space insurance coverage with new vehicles, however you don't have to finance it through the dealer. Acquisition it from your cars and truck insurer or store around for rates. Vehicles are a major acquisition, and you do not wish to regret buying one prep work is essential! Contrast cars and truck costs around your area and constantly discuss based on the out-the-door rate.

The wholesale rate is what dealers spend for made use their explanation of autos at auction. Wholesale rate decreases generally come before retail price visit six to 8 weeks. A price decrease is constantly a great sign for secondhand vehicle consumers. But before you start doing the happy-car-shopper dance, remember the market is still hard.

You may locate yourself making some concessions in what you desire versus what is readily available, whether purchasing from a supplier or a personal vendor. Loan providers are tightening their belts and their credit rating demands. Rates of interest, commonly greater for made use of auto loan than brand-new auto loan, are progressively escalating. To put it simply, if you fund a previously owned car, the monthly settlements will be higher currently than a year back.

It's affected as much by the quantity of time and money you can invest as anything else. Nonetheless, right here we will certainly lay out the excellent, the poor, and the ugly about both buying alternatives. You might be unwilling to buy a used vehicle from a private vendor (occasionally described as peer-to-peer) if you never purchased this way prior to

The Ultimate Guide To Modern Nissan Of Lake Norman

There are more unknowns in a peer-to-peer (P2P) deal. A strong reason for purchasing peer-to-peer is due to the fact that the seller has the automobile you desire at a fair cost.

Furthermore, a personal vendor does not have to cover the overhead costs a car dealership generates. A dealership is actually an intermediary in the transaction, producing the needed profit by pumping up the acquisition rate when marketing the vehicle. Nevertheless, at the end of the day, the peer-to-peer bargain will just be like the customer's negotiating abilities.

In theory, a private vendor's initial asking cost will certainly be less than a dealer's rate for the reasons itemized above. Subsequently, negotiating a transaction cost with an exclusive seller ought to start at a lower limit than when negotiating with a dealer. This, however, isn't a buyer's only benefit. By the time the customer and vendor get to the working out phase, the exclusive vendor has actually spent a lot of time in offering you a cars and truck.

Report this page